【Introduction】In the first quarter of 2025, the export momentum of citric acid rebounded significantly, with a month-on-month decrease of 1.3% and a year-on-year increase of 17.3%. India is China's largest trading partner for citric acid, accounting for 14.3% of exports. With the slowdown in the pace of overseas order signing in the second quarter, demand expectations weakened, coupled with the relatively loose domestic supply, it is expected that the export volume and price of citric acid in the second quarter may both fall.

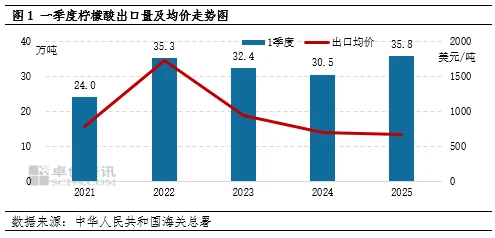

In the past five years, the export data of citric acid in the first quarter showed an "N-shaped" trend. According to statistics from the General Administration of Customs of the People's Republic of China, the export volume of citric acid in the first quarter of 2025 was 358,000 tons, which was at a high point in the past five years, a year-on-year increase of 17.3%, and an increase of 49.2% from the low point in 2021; the average export price was US$664.39/ton, a year-on-year decrease of 5.4%, and a decrease of 61.55% from the high point in 2022. After the public health incident, with the resumption of overseas production and the release of new domestic production capacity, the supply and demand of the citric acid market was loose, and the average price gradually declined, but due to the constraints on the cost side, the price decline slowed down after 2023.

Analysis of citric acid export registration places in the first quarter

East China is the main production area of citric acid in China and also the main export registration place, with provinces including Shandong, Jiangsu and Anhui. According to statistics from the General Administration of Customs, Shandong Province exported 294,500 tons in the first quarter of 2025, accounting for 82.36% of the total citric acid exports, ranking first; Jiangsu Province exported 19,900 tons, ranking second, accounting for 5.57% of the total citric acid exports, a year-on-year decline of 0.91%; Anhui Province exported 12,000 tons, accounting for 3.35% of the total citric acid exports, a year-on-year increase of 0.67%. In addition, Jilin Province's export volume increased significantly, with an export volume of 12,900 tons in the first quarter, accounting for 3.60% of the total citric acid exports, an increase of 2.67 percentage points year-on-year. Overall, Shandong Province, as the largest production area, has slightly decreased its export share; on the other hand, the export share of other major production areas has rebounded slightly.

Analysis of citric acid export trading partners in the first quarter

Asia and Europe are the main export regions for Chinese citric acid. In recent years, China's citric acid export trading partners are mainly India, Russia, Mexico, Japan, Turkey and other countries. In the first quarter of 2025, India ranked first with an import volume of 51,100 tons, a year-on-year increase of 47.39%, accounting for 14.30% of China's total exports; Mexico's imports were 18,200 tons, a year-on-year decrease of 14.94%, accounting for 5.08% of China's total exports. Japan's imports were 14,000 tons, a year-on-year increase of 14.10%, accounting for 3.93% of China's total exports; in the first quarter of 2025, Mexico, Poland and Russia's imports fell year-on-year, and the decline was large. On the other hand, India, Pakistan and Germany's exports increased year-on-year. Overall, China's citric acid exports were higher than in previous years, and some new trading partners had significant increases.

Citric acid exports may decline in the second quarter

Citric acid exports face downward pressure in the second quarter. On the one hand, stimulated by the price increase in the first quarter, the operating load of citric acid enterprises increased, domestic supply gradually eased, and prices continued to rise under pressure. In addition, there is uncertainty in the current tariff policy, and overseas wait-and-see sentiment is strong; on the other hand, the second quarter is the regular export off-season, the overseas market maintains rigid demand, and the overall pace of signing orders slows down. It is expected that the export volume of citric acid in the second quarter may decline, estimated at 319,000 tons, a year-on-year decrease of about 10.8%.